New York Car Trade In Sales Tax . when you register a vehicle in new york state (at a dmv office), you must. the car sales tax in new york is 4% of the purchase price of the vehicle. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. Pay the sales tax, prove that sales tax was paid,. For instance, if you pay $40,000 for a new. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. There are also a county or local taxes of up to 4.5%. new york collects a 4% state sales tax rate on the purchase of all vehicles. This statewide tax does not. However, depending on the city or. if you are required to collect new york state and local sales tax from.

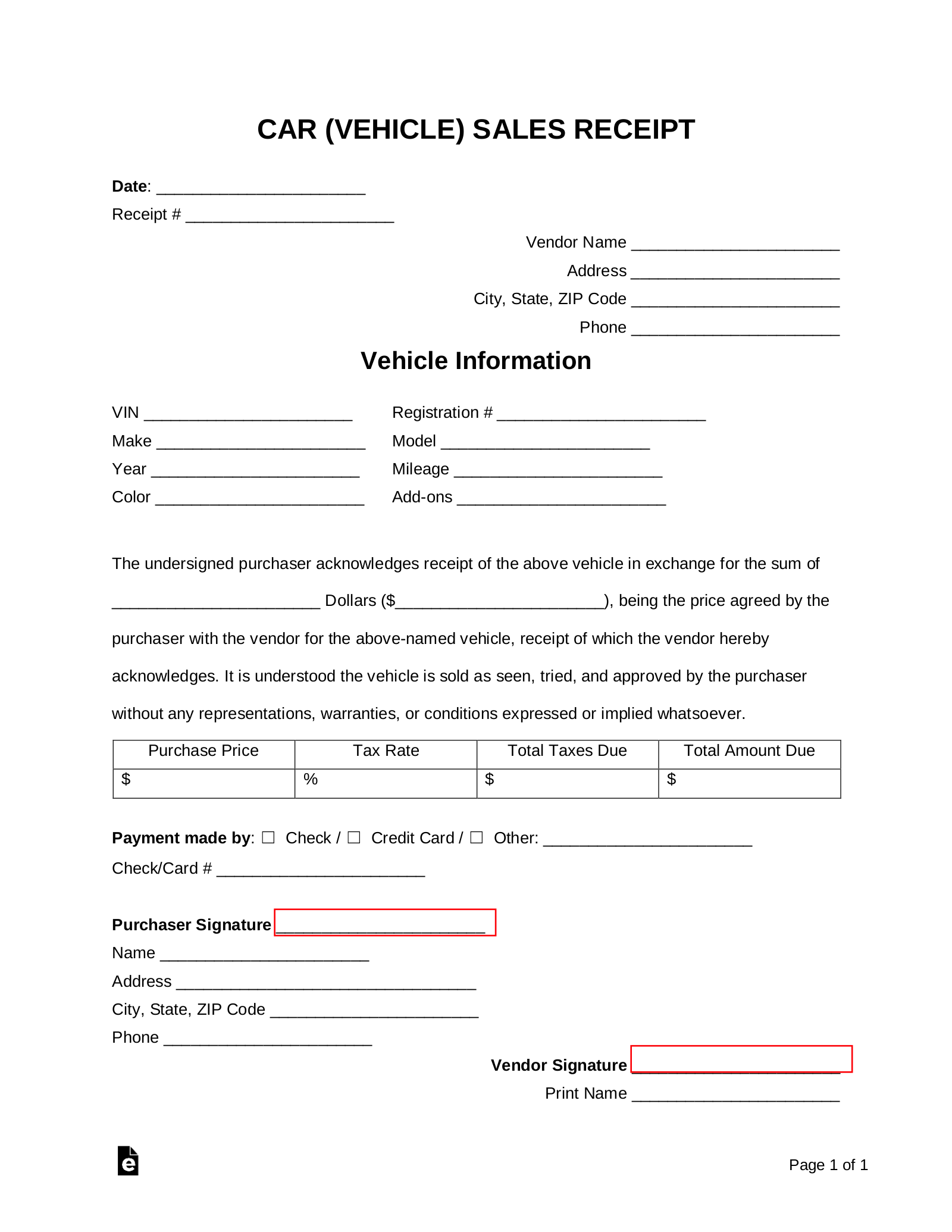

from eforms.com

if you are required to collect new york state and local sales tax from. the car sales tax in new york is 4% of the purchase price of the vehicle. For instance, if you pay $40,000 for a new. Pay the sales tax, prove that sales tax was paid,. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. new york collects a 4% state sales tax rate on the purchase of all vehicles. There are also a county or local taxes of up to 4.5%. However, depending on the city or. when you register a vehicle in new york state (at a dmv office), you must.

Free Car (Vehicle) Sales Receipt Template PDF Word eForms

New York Car Trade In Sales Tax for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. However, depending on the city or. Pay the sales tax, prove that sales tax was paid,. There are also a county or local taxes of up to 4.5%. when you register a vehicle in new york state (at a dmv office), you must. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. For instance, if you pay $40,000 for a new. if you are required to collect new york state and local sales tax from. the car sales tax in new york is 4% of the purchase price of the vehicle. This statewide tax does not. new york collects a 4% state sales tax rate on the purchase of all vehicles. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states.

From www.valuepenguin.com

Who Has the Cheapest Auto Insurance Quotes in New York? ValuePenguin New York Car Trade In Sales Tax when you register a vehicle in new york state (at a dmv office), you must. This statewide tax does not. Pay the sales tax, prove that sales tax was paid,. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. the car sales. New York Car Trade In Sales Tax.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates New York Car Trade In Sales Tax when you register a vehicle in new york state (at a dmv office), you must. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. This statewide tax does not. However, depending on the city or. for sales tax purposes, a business is. New York Car Trade In Sales Tax.

From www.totalmortgage.com

Tread Carefully when Buying or Selling a Short Sale Home Total New York Car Trade In Sales Tax There are also a county or local taxes of up to 4.5%. the car sales tax in new york is 4% of the purchase price of the vehicle. new york collects a 4% state sales tax rate on the purchase of all vehicles. when you register a vehicle in new york state (at a dmv office), you. New York Car Trade In Sales Tax.

From www.copilotsearch.com

The Best Used Car Dealerships in New York City CoPilot New York Car Trade In Sales Tax the car sales tax in new york is 4% of the purchase price of the vehicle. This statewide tax does not. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. For instance, if you pay $40,000 for a new. However, depending on the. New York Car Trade In Sales Tax.

From beckyykarlyn.pages.dev

Sales Tax Calculator 2024 Nys Sheri Riannon New York Car Trade In Sales Tax For instance, if you pay $40,000 for a new. when you register a vehicle in new york state (at a dmv office), you must. Pay the sales tax, prove that sales tax was paid,. There are also a county or local taxes of up to 4.5%. the car sales tax in new york is 4% of the purchase. New York Car Trade In Sales Tax.

From exooxfokf.blob.core.windows.net

Cars For Sale Facebook Marketplace Ny at Walter Humes blog New York Car Trade In Sales Tax for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. new york collects a 4% state sales tax rate on the purchase of all vehicles. the car sales tax in new york is 4% of the purchase price of the vehicle. Pay the sales tax, prove. New York Car Trade In Sales Tax.

From eforms.com

Free New York Motor Vehicle Bill of Sale Form MV912 PDF eForms New York Car Trade In Sales Tax This statewide tax does not. There are also a county or local taxes of up to 4.5%. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according. New York Car Trade In Sales Tax.

From guestofaguest.com

The Best Thing About Having A Car In New York... New York Car Trade In Sales Tax when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. This statewide tax does not. However, depending on the city or. Pay the sales tax, prove that sales tax was paid,. if you are required to collect new york state and local sales tax. New York Car Trade In Sales Tax.

From taxfoundation.org

State and Local Sales Tax Rates in 2014 Tax Foundation New York Car Trade In Sales Tax For instance, if you pay $40,000 for a new. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. the car sales tax in new york is 4% of the purchase price of the vehicle. This statewide tax does not. if you are. New York Car Trade In Sales Tax.

From www.hotzxgirl.com

Fact Check New York Has The Highest Taxes Whec Hot Sex Picture New York Car Trade In Sales Tax when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. if you are required to collect new york state and local sales tax from. new york collects a 4% state sales tax rate on the purchase of all vehicles. when you register. New York Car Trade In Sales Tax.

From www.carsalerental.com

When Do I Pay Sales Tax On A New Car Car Sale and Rentals New York Car Trade In Sales Tax new york collects a 4% state sales tax rate on the purchase of all vehicles. Pay the sales tax, prove that sales tax was paid,. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. for sales tax purposes, a business is a. New York Car Trade In Sales Tax.

From pxhere.com

Free Images road, traffic, street, urban, manhattan, taxi, cab, busy New York Car Trade In Sales Tax Pay the sales tax, prove that sales tax was paid,. However, depending on the city or. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. For instance, if you pay $40,000 for a new. when you register a vehicle in new york state (at a dmv. New York Car Trade In Sales Tax.

From www.94nissan.com

How to Sell A Used Car To A Dealership New York Car Trade In Sales Tax There are also a county or local taxes of up to 4.5%. when you register a vehicle in new york state (at a dmv office), you must. Pay the sales tax, prove that sales tax was paid,. However, depending on the city or. new york collects a 4% state sales tax rate on the purchase of all vehicles.. New York Car Trade In Sales Tax.

From www.youtube.com

How to sell a car in New York YouTube New York Car Trade In Sales Tax Pay the sales tax, prove that sales tax was paid,. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. the car sales tax in new york is 4% of the purchase price of the vehicle. new york collects a 4% state sales tax rate on. New York Car Trade In Sales Tax.

From cejifccb.blob.core.windows.net

Cars For Sale By Owner Bay Area at Wendy Bales blog New York Car Trade In Sales Tax when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. This statewide tax does not. However, depending on the city or. new york collects a 4% state sales tax rate on the purchase of all vehicles. There are also a county or local taxes. New York Car Trade In Sales Tax.

From www.tiains.com

New York Auto Dealers Insurance Tanner Insurance Agency Inc New York Car Trade In Sales Tax the car sales tax in new york is 4% of the purchase price of the vehicle. new york collects a 4% state sales tax rate on the purchase of all vehicles. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. Pay the sales tax, prove. New York Car Trade In Sales Tax.

From simpleinvoice17.net

Invoice For Car Sale * Invoice Template Ideas New York Car Trade In Sales Tax when you register a vehicle in new york state (at a dmv office), you must. when buying a car in new york, you will pay a 4% sales tax rate for your new vehicle, according to sales tax states. For instance, if you pay $40,000 for a new. for sales tax purposes, a business is a resident. New York Car Trade In Sales Tax.

From www.carsalerental.com

How To Pay For A Car Private Sale Car Sale and Rentals New York Car Trade In Sales Tax For instance, if you pay $40,000 for a new. This statewide tax does not. for sales tax purposes, a business is a resident of a new york state taxing jurisdiction if it carries on any. There are also a county or local taxes of up to 4.5%. when buying a car in new york, you will pay a. New York Car Trade In Sales Tax.